Access to low-cost and long-term financing is crucial for accelerating the energy transition and improving the economic viability and competitiveness of renewable energy.

According to BloombergNEF’s New Energy Outlook, the world needs to spend a total of $8.3 trillion on renewable energy deployment between 2023 and 2030 to align with a global net-zero trajectory by 2050.

Although the world is already investing around $1 billion a day in solar PV, there is still a critical gap in the finance needed to realize an energy system with solar as the backbone, especially in emerging markets.

Climate finance must prioritize channeling financial instruments towards essential solutions that are key to deploying more solar justly and sustainably across the world, such as the scaling-up of supply chain, the development and implementation of solar projects, as well as energy infrastructure upgrades like electricity grid expansion and flexibility measures.

The world needs to spend a total of $8.3 trillion on renewable energy deployment between 2023 and 2030 to align with a global net-zero trajectory by 2050.

GSC’s work on Finance

The Global Solar Council is committed to unlocking the capital needed to drive the solar transition. We work to ensure that solar PV markets around the world—especially in emerging economies—have access to affordable, innovative, and scalable financing solutions. From advocating for increased flows of public and private investment toward solar infrastructure, to supporting mechanisms like power purchase agreements (PPAs), concessional finance, and blended finance models, GSC champions financial frameworks that lower risk and enhance bankability.

Our work also emphasizes the critical need to mobilise $12 trillion, as set out by the Global Renewables Alliance, to triple renewable energy capacity by 2030, aligned with the #3xRenewables global goal set by governments. We collaborate with Multilateral Development Banks, governments, and investors to shape policy, streamline permitting, and promote financial instruments that support solar deployment at all scales—rooftop, utility-scale, and off-grid.

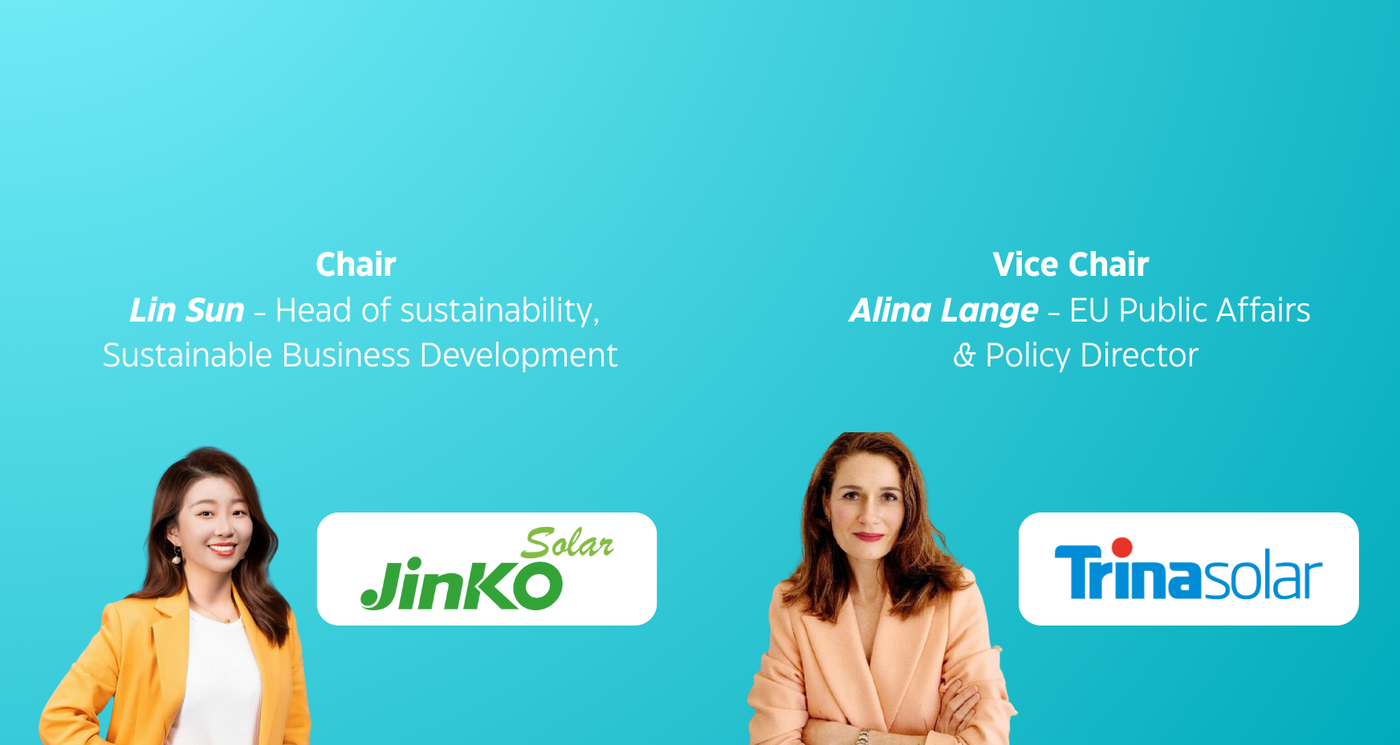

Finance Task Force

GSC created its Finance Task Force in 2024, chaired by Ms Lin Sun of Jinko Solar, with Ms Alina Lange from Trina Solar as Vice Chair. This group brings together members of the GSC - both national associations and companies - to discuss and address financing challenges and develop best practices and solutions to deploy in countries across the world.

The Task Force will publish a report at London Climate Action Week 2025, providing in-depth analysis on the solar finance landscape, and GSC's recommendations on how to scale and lower the cost of finance for solar PV globally.

International Solar Finance Group

At COP29 in Baku, GSC launched its International Solar Finance Group, a dialogue platform comprising of both public and private banks, investment funds, MDBs and solar industry representatives to work together to solve the barriers preventing further mobilisation of capital for solar PV in developed and developing countries.

The initial focus of the group is rapidly advocating and deploying solutions to lower the cost of capital for solar PV in emerging markets.

Want to get involved in our Finance Working Group?

![Global Solar Council [logo]](/static/images/gsc-logo-horizontal.svg)